Freight Contract Negotiations Stand On Tricky Ground As Spot Rates Continue To Fall

The post-Chinese New Year market has shaped up as anticipated, with spot rates continuing to dip across the Far East-US trade lane. S&P Global data on Asia-US spot rates have fallen sharply since CNY, with spot rates at $3,900 per FEU between the Asia-US West Coast corridor and $5,560 per FEU in the Asia-US East Coast trade lane. This is a roughly 12-15% fall in spot rates from the first week of Feb ‘24 for trans-Pacific eastbound freight.

The Shanghai Containerized Freight Index (SCFI) reflects a similar picture of the freight market's weakness, showing a steady decline over the last month.

However, considering this is contract season, ocean carriers have not stopped pushing shippers to sign annual freight contracts at prices much higher than their current market rate.

The carriers ‘insistence’ on higher freight contract prices is driven by the disparity between spot and contract rates. While spot rates have been on a downward trend, they are still far from the levels seen in March ‘23, when rates plummeted to a point where carriers struggled to maintain profitability. S&P data from late Mar ‘23 shows that spot rates were approximately 60% lower than the current rates on the trans-Pacific trade lanes.

.jpeg)

Clearly, the carriers’ push to sign contracts at much higher prices relies on the disruptions we have seen in the two wet canals — with the Red Sea crisis creating a Suez Canal bottleneck and persisting drought across the Panama Canal. However, vessels have adjusted to going around the Horn of Africa, and while this does increase lead times for shippers, it does not disrupt operations like the logistical bottlenecks during the pandemic. Similarly, water levels in the Panama Canal have been rising, with the corridor reaching almost 90% of its pre-drought capacity.

This leads us to the carriers’ current desperation in signing new contracts in the wake of falling spot rates. While demand for freight capacity has not taken a dive, disruptions do not threaten shipper operations enough for them to sign contracts at a premium. Demand aside, carriers also have a supply problem. The new ships they ordered on the back of surreal profits during ‘21 are now being added to their fleet, increasing available capacity and straining their operational margins further.

The Silq Take For Shippers

For shippers discussing terms with their carrier partners, our advice is not to panic and sign contracts. Fresh contracts usually come on board on May 1, and we expect spot prices to fall further, helping shippers negotiate contract terms better. This year, delaying tactics will work in favor of shippers, as lukewarm demand and increasing capacity availability will give shippers more ammunition to face their contract discussions as the weeks pass.

From the carriers’ perspective, they hope that if negotiations lengthen well into April, shippers will see their existing contracts end. No fresh contract at this juncture would result in shippers putting all their freight on the spot market, a situation they are rightly looking to avoid.

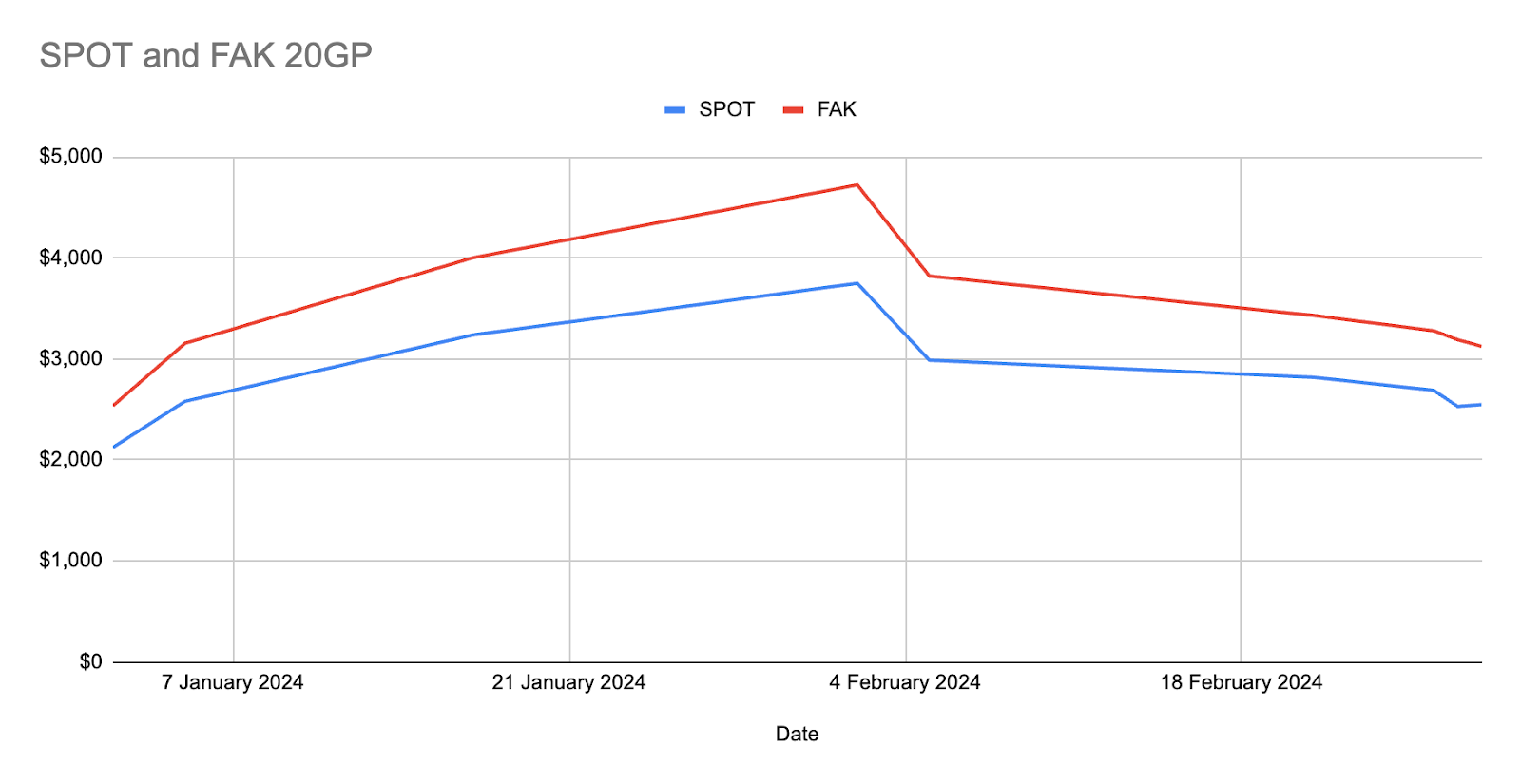

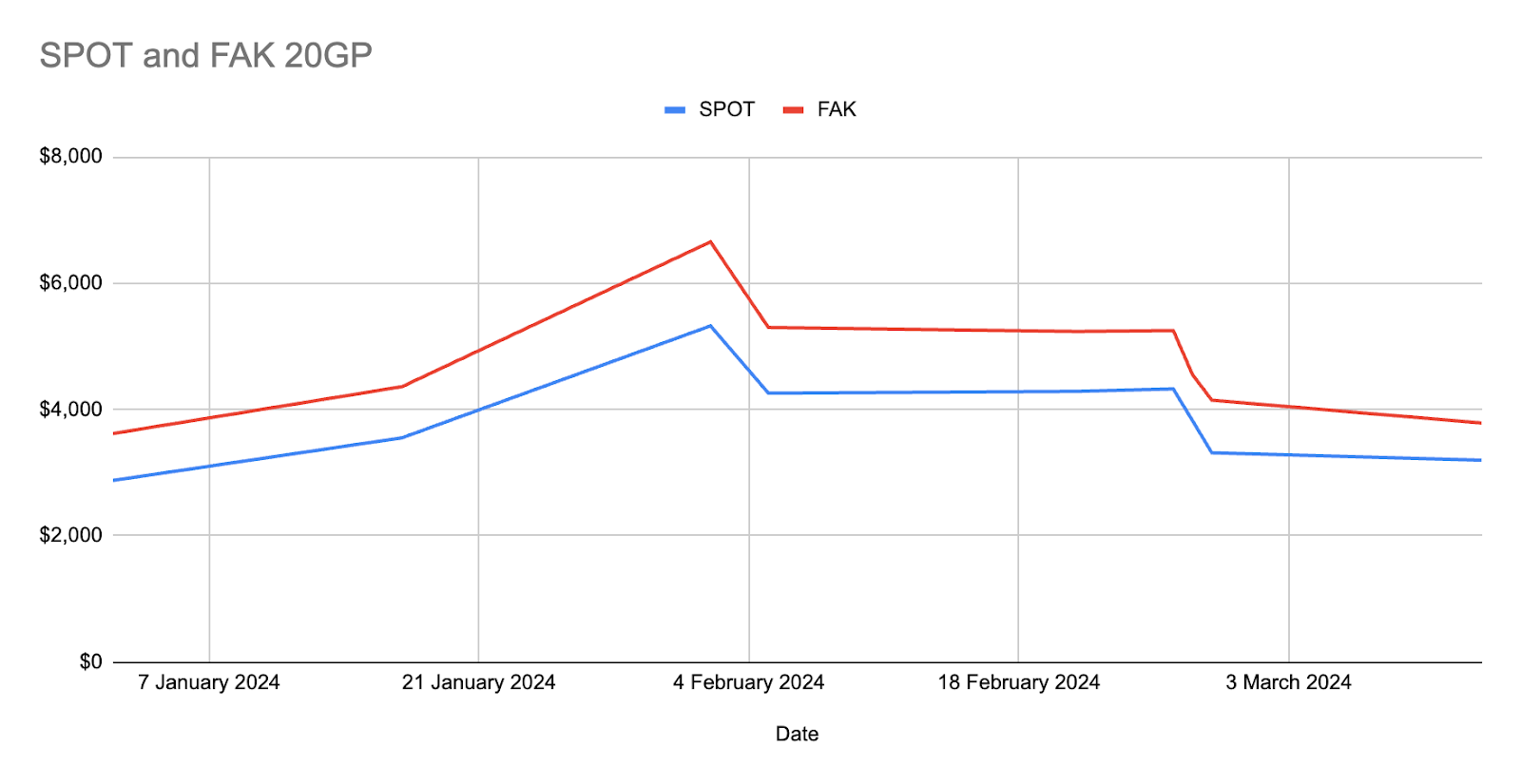

At Silq, we strongly believe this is not a problem and that shippers should delay signing contracts as long as possible. This advice is based on Silq’s internal spot and contract rate data. Silq’s spot rates (the ones we provide our shipper clients) are well below the market spot rates.

Interestingly enough, even our FAK (freight all kinds) rates are below market spot rates. Considering FAK rates are marginally higher than contract rates, Silq’s ground reality is that contract rates offered in the market are higher than the spot rates we offer.

Silq consistently beats the market with the help of our freight partners, and the trust and reliability we’ve built with them over the years. This enables us to get rates that are well below the industry average, which in turn helps our customers save on their logistics costs.

Are you a shipper looking to avoid the headache of negotiating contracts, but still want to reduce your logistics costs? Do connect with us.

Ready for Supply Chain Predictability?

Importers using Silq ship smarter, safer, and with total control.