A Guide to De Minimis Threshold Value Ruling

The U.S. is the biggest market in the world and, as such, will be exposed to the importation and exportation of goods of all sorts. However, the country can not afford to manage all of them nor tax all of them if it hopes to enhance trade. In keeping with this, Congress passed the de minimis threshold value ruling into law. This way, goods below a certain threshold are not subject to import duties and formal clearance from customs. In this case, that threshold is $800.

The de minimis threshold value ruling has recently gained significant attention, especially in e-commerce. With e-commerce giants from outside the U.S. exploring and taking advantage of it, understanding this ruling is crucial for any business involved in international trade.

The ruling affects both business-to-business (B2B) and business-to-consumer (B2C) transactions. What exactly is it, how does it work, and who can take advantage of it? These are the questions we’ll answer in this guide.

The de minimis ruling isn’t just about reducing the cost of shipping, although that is a major plus for shippers. The absence of formal customs clearance procedures also means that the shipping process is much faster, meaning shorter lead times for these companies. Understanding the de minimis ruling can help more businesses and supply chains enhance their operations and customer satisfaction.

Understanding The De minimis Threshold Value Ruling

“De minimis non curat lex.” The law does not concern itself with trifles. That is the origin of the de minimis ruling, which means that for the United States government, the administrative cost of processing such goods and collecting revenue or taxes on the product far outweighs the revenue the government can collect on such goods.

Although the ruling has an ancient context, it was recently integrated into United States law, and its value has been revised several times over the years. In 1930, it was $10; after many revisions to the price over the years, in 2016, it was raised from $200 to $800, which was the most significant increase to date. So far, it has worked well for all parties involved.

The de minimis threshold value ruling also applies to services online, facilitating smoother transactions for digital products and services.

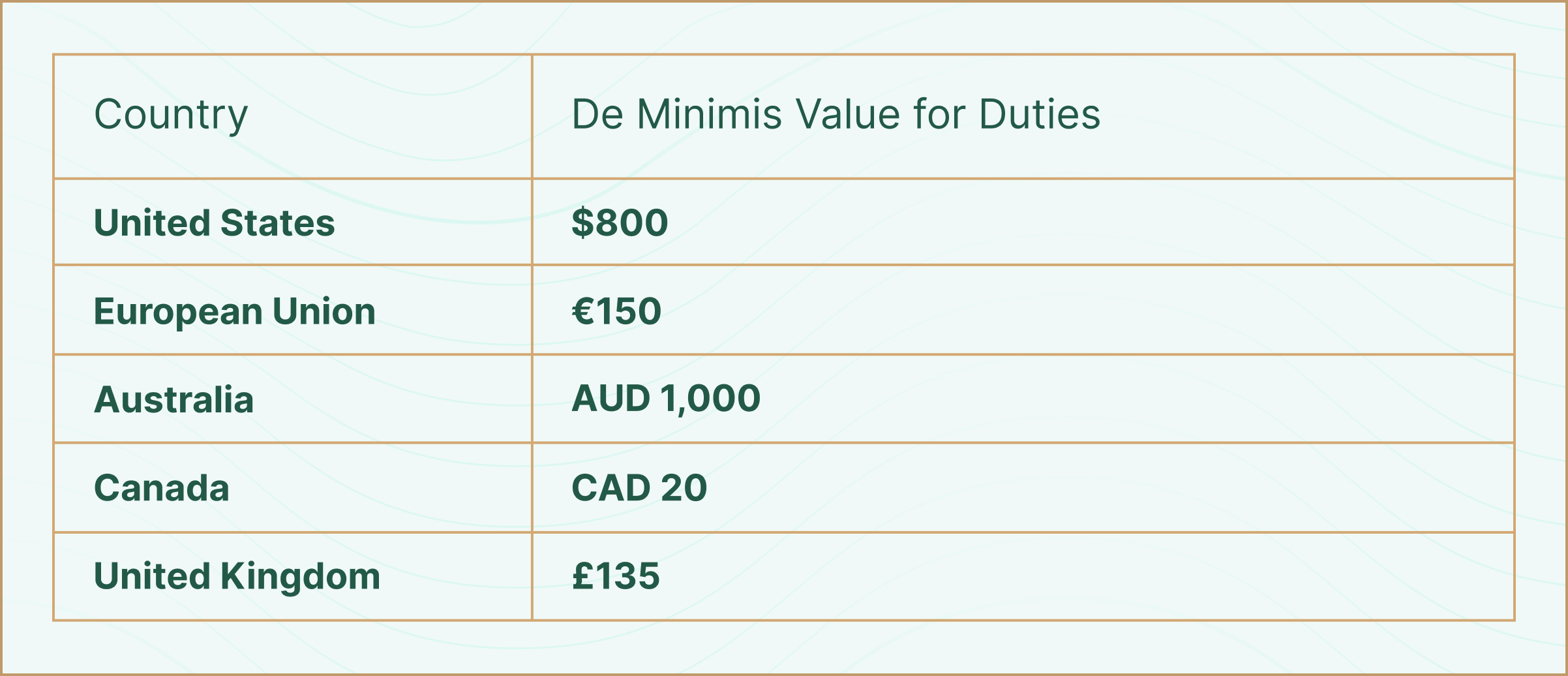

Different countries have or operate their own de minimis threshold or value. Here are some of the top economies in the world:

What Deminimis Threshold Value Ruling Means for Ecommerce Business

The electronic commerce business model perfectly suits the de minimis threshold ruling and presents plenty of opportunities because shipments are based on individual orders, which can be very small or huge, depending on the customer. Smaller shipments, which make up the bulk of retail e-commerce sales, are mostly below the threshold, allowing for:

1. Reduced Cost of Shipping

The lack of duties and taxes on the shipments enhances their ability to save significantly in shipping operations. While that may not seem like a lot at first glance, do that for thousands of goods every day, and the cost starts to add up. This allows the online store to reduce the price of goods, potentially leading to more online purchases.

2. Stress-Free Customs Clearance

Customs clearance can be a pain for businesses and supply chains. The extra scrutiny can often slow them down. However, because of the de minimis ruling, e-commerce businesses do not have to go through all of that, meaning less risk of supply chain disruptions.

3. Rapid Expansion of Market Reach Through Online Shopping

When you only have to ship goods without worrying about clearance, duties, and taxes, the pricing model and supply chain become much more simplified, leading to more sales and patronization from customers around the globe. It’s a great way to leverage LCL shipping.

However, it is not all about opportunities for e-commerce businesses. It also comes with its fair share of challenges, such as the risk of misuse through undervaluation, increased competition from foreign sellers and online sales, and the need to comply with other regulations.

Each e-commerce business will have a different experience with the de minimis ruling, so while it can benefit them, it's essential to be aware of the potential risks and operate within legal and ethical boundaries.

How E-commerce Platforms and Supply Chains Can Navigate De Minimis Threshold Value Ruling

Because the de minimis threshold impacts online retail sales and their supply chains, careful and precise navigation of the rule is critical to maintaining success. Here are some strategies to effectively manage these regulations:

1. Understand Country Specific Thresholds

The de minimis value varies differently and significantly across countries and regions. Some markets do not have a de minimis threshold. Therefore, a key step in managing the de minimis threshold is to thoroughly research and understand the specific rules and expectations guiding the de minimis value of each country to which the business ships.

2. Accurate Valuation of Goods for Online Sales

Wrong or inaccurate valuation of goods can be harmful to a business, especially because it leads to penalties and blacklisting. Therefore, ensuring accurate valuation is critical. To do this properly, leverage the transaction value (i.e. the price paid or payable for the goods).

3. Utilize Technology

Understanding and navigating the de minimis threshold can be cumbersome, especially when selling one. However, by leveraging technology solutions, more businesses can streamline the entire shipping process to successfully take advantage of them. Shipping software can ensure adequate documentation and transparency/visibility for all stakeholders involved, especially for customers using the ecommerce website.

4. Stay Informed

Rules change, and currently, the U.S. Congress is considering taking action on the de minimis ruling, which Chinese e-commerce platforms are taking advantage of. Being informed allows shippers to stay up to date about changes to the rules across the various regions they operate in. Some key ways of achieving this are by subscribing to relevant newsletters, following industry publications, and consulting with experts to stay informed and adapt your business practices accordingly.

5. Partner With Experts

Experts help streamline and optimize shipping operations, from freight forwarders to customs brokers and third-party logistics providers. Partnering with the right shipping service providers opens the supply chain to more capacity and throughput.

How Silq Leveraged De Minimis Threshold Value Ruling And Streamlined Operations

Sarah, the owner of a thriving online clothing boutique in Texas, was always searching for unique and affordable pieces to offer her customers. She had recently discovered a fantastic supplier in China who offered beautiful, handcrafted garments at incredibly competitive prices. However, the import duties and lengthy customs procedures had always deterred her from placing large orders.

That was until she learned about the de minimis threshold value ruling. This game-changing regulation allowed her to import goods valued under $800 without incurring any duties or undergoing formal customs clearance. She quickly partnered with Silq, a logistics company specializing in cross-border shipping. Silq's expertise and network ensured that Sarah's shipments from China arrived at a U.S. port swiftly and efficiently. But instead of clearing customs in the U.S., Silq seamlessly transported the goods across the border to a warehouse in Mexico.

By utilizing the USMCA (United States-Mexico-Canada Agreement), a free trade agreement, Sarah could now bring her goods into the U.S. for fulfillment without incurring additional taxes or tariffs. Her inventory was safely stored in Mexico, ready to be shipped to her customers throughout North America whenever orders were placed.

The impact on Sarah's business was remarkable. She was able to offer her customers a wider variety of unique clothing items at lower prices, thanks to the reduced costs associated with the de minimis ruling and the USMCA.

Why Partnering With Silq Gives You The Best Chance For Successfully Navigating De Minimis Threshold Value Ruling

Silq is a digital freight forwarding platform that enhances your shipping operations through a unique combination of technology, expertise, and experience. We have the best shipping solutions, whether it is for LCL or FCL shipping and through air freight or ocean freight. Silq has boots on the ground, with its inspectors ensuring your shipment is checked and safely secured in the freight containers before their voyage. As an ecommerce company looking to leverage the de minimis ruling, work with Silq, and have a seamless shipping experience devoid of logistics hiccups. Get started now.

Ready for Supply Chain Predictability?

Importers using Silq ship smarter, safer, and with total control.